GSTR-3B is an essential monthly return that every registered taxpayer has to file monthly or quarterly.

GSTR-3B should be submitted by all those businesses liable to file the monthly returns of GSTR-1 or GSTR-3.

Taxpayers can easily file their GSTR-3B online through the GSTN portal.

This short article will discuss the GSTR-3B filing due dates and discuss some of the most common errors that taxpayers make while filing their GSTR-3B return.

GSTR-3B due dates

| Sr. No | GSTR-3B opted (Monthly or Quarterly?) | Place of business of taxable person(State/UT) | GSTR-3B filing due date |

| 1 | Monthly filing | All the states & UT | 20th of the following month |

| 2 | Quarterly filing | Category 1 1 states/UT (Chhattisgarh, Madhya Pradesh, Gujarat, Maharashtra, Karnataka, Goa, Kerala, Tamil Nadu, Telangana, Andhra Pradesh, Daman & Diu and Dadra & Nagar Haveli, Puducherry, Andaman and Nicobar Islands, Lakshadweep) | 22nd of the following month |

| 3 | Quarterly filing | Category 1 states/UT (Himachal Pradesh, Punjab, Uttarakhand, Haryana, Rajasthan, Uttar Pradesh, Bihar, Sikkim, Arunachal Pradesh, Nagaland, Manipur, Mizoram, Tripura, Meghalaya, Assam, West Bengal, Jharkhand, Odisha, Jammu and Kashmir, Ladakh, Chandigarh, Delhi) | 24th of the following month |

Common mistakes while GSTR-3B filing

Rectification of GSTR-3B is not possible under GST.

Hence, it is essential that the taxable person needs to file all the returns with utmost accuracy.

General mistakes that the taxpayers make while GSTR-3B are listed hereunder-

1. Delayed or non-filing pf GSTR-3B returns before the due date.

- This is the fundamental mistake that the taxpayers make, which applies to all the type of GST returns.

- The taxpayers should file their GSTR-3B returns well before the due date for their existing filing category.

- The GSTR-3B due date for the taxpayers opting for quarterly filing is different than those opting for monthly filing.

- It is advised that the on-time or beforehand filing of GSTR-3B under GST should be taken seriously to avoid the penalties afterwards.

- With the timely filing of GSTR-3B return or any other GST return for that matter, the taxable person can easily avoid payment of GSTR-3B late fee as well as interest.

2. Non-filing of GSTR-3B form for ‘NIL’ returns

- There has always been a misconception amongst the taxpayers around the NIL return filing.

- Taxpayers assume that there is no need to file the return for that tax period when there are no transactions for a particular month or quarter (i.e., no inward supply, no outward supply and no input tax credit).

- However, this is NOT TRUE. It should be noted with due diligence that NIL return filing is made MANDATORY under GST.

- Failure to file a NIL return in Form GSTR-3B results in late fees on a per-day basis until the NIL return is not furnished.

- The Government has introduced NIL return filing via SMS to 14409 to ease the taxpayer’s efforts further and encourage him to file the NIIL returns in his GSTR-3B form.

3. Clerical mistakes while GSTR-3B filing

- While filing GSTR-3B returns under GST, the taxpayer should carefully mention the tax amount; the Input Tax Credit undr GSTclaimed and amounts of the outward & inward supplies.

- Rectification of GSTR-3B is NOT ALLOWED once the return is filed. Hence, the taxpayers should furnish the data with utmost accuracy and diligence.

- Clerical mistakes are a big NO while filing your GSTR-3B returns. Hence, it would be best to use an automated GST filing software for all your GST returns filing process.

4. Not mentioning the Debit notes & Credit notes details

- This is a particular mistake that we would like to focus your attention on.

- Furnishing correct outward supplies is an essential part of GSTR-3B filing.

- However, many a time, the details about the debit notes/ credit notes issued during the tax period are left out.

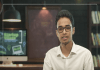

- As shown in the screenshot above, taxpayers need to furnish their credit & debit note details in column-a of Table 3.1 of the GSTR-3B form.

5. Incorrect furnishing of export figures in GSTR-3B

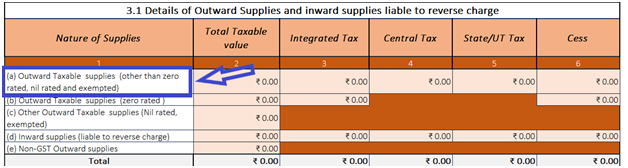

- Table 3.1 of the GSTR-3B form covers the details of outward and inward supplies as shown below:

- Column 3.1 (b) & column 3.1(c) will carry these details of the export figures.

- The values of exports and the value of supplies to Special Economic Zones are supposed to be reflected in column 3.1(c) off the GSTR-3B form.

- Furnishing incorrect details can take a toll on your uninterrupted Input Tax Credit claim under GST.

6. Furnishing details of Input Tax Credit for normal purchases

- GSTR-3B form is a comprehensive document where you need to furnish every detail for a particular tax period.

- GST Input Tax Credit claimed in that tax period must also be mentioned in the GSTR-3B form.

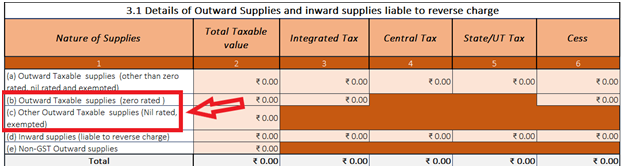

- Table 4 of the GSTR-3B form comprises the columns where you have to furnish your Input Tax Credit details.

- Table 4 of the GSTR-3B, column A gives the classification of available Input Tax Credit into five types.

- However, there is no separate classification in column A of Table 4 for the Input Tax Credit available against the ‘Normal Purchases’.

- The taxpayers often miss adding the details about their Input Tax Credit on ‘Normal Purchases’ due to the absence of the specific column.

- The taxpayers should note that they should add the ITC details on ‘Normal Purchases’ in the ‘All Other ITC‘ section in column A.

- Interestingly, many taxpayers either omit to add these details in GSTR-3B or add them incorrectly in other sections between one & four.

Taxpayers should be very keen when they furnish the details in their GSTR-3B form under GST.

As mentioned earlier, it is not possible to edit the GSTR-3B form once it is filed. SO, it is better to take precautionary measures for filing accurate details rather than dealing with the further tax implications.

Tax advisors and GST experts have time and again suggested the taxpayers use an automated solution for all their GST returns filing tasks. This reduces the chances of errors and helps you be accurate and claim maximum Input Tax Credit under GST.

To sum it up

GSTR-3B form under GST is an essential document in the GST return filing process of the entire financial year.

Hence, utmost diligence should be observed to eliminate possible mistakes during the GSTR-3B filing online.

Taxpayers can use an automated solution like GSTHero to completely automate their GST return filing experience and eliminate possible human errors.

Follow the tips given in the article to help you minimize human errors while filing the GSTR-3B returns in GST.

Stay updated; stay ahead!